Re-channeling Special Drawing Rights for a Climate Resilient and Just Transition: Prospects for a Resilience and Sustainability Trust

In a historic breakthrough for the multilateral system, the International Monetary Fund (IMF) approved the global allocation of $650 billion in Special Drawing Rights (SDRs)—the inter- national reserve asset issued by the IMF—to support liquidity and foster the resilience of the global economy in the wake of the COVID-19 pandemic. While unprecedented in its scope, […]

The Need for a Development-Centered Climate Change Policy at the International Monetary Fund

Climate change and climate change policy pose significant risks to financial and fiscal sta- bility. They also pose risks and offer opportunities for growth and development prospects. As the only multilateral, rules-based institution charged with maintaining the stability of the international financial and monetary system, the International Monetary Fund (IMF) should put in place an […]

Potential Roles for Export Credit Agencies in Catalyzing Private Sector Green Financing

Conventional sources of funding will be insufficient to finance essential sustainable energy infrastructure. Southeast Asian countries, therefore, need to access international and national sources of finance such as ECAs to drive low-carbon and climate-resilient development alongside their recovery from the COVID-19 pandemic. Download File

Accelerating Resilience and Climate Change Adaptation: Strengthening the Philippines’ Contribution to Limit Global Warming and Cope with its Impacts

In its first Nationally Determined Contribution (NDC) to the Paris Agreement, the Philippines committed to a GHG emissions reduction/avoidance of 75 percent for the period 2020 to 2030, referenced against a projected business-as-usual cumulative emission for the same period. However, the numbers do not add up, critical sectors such as forestry, which is central to […]

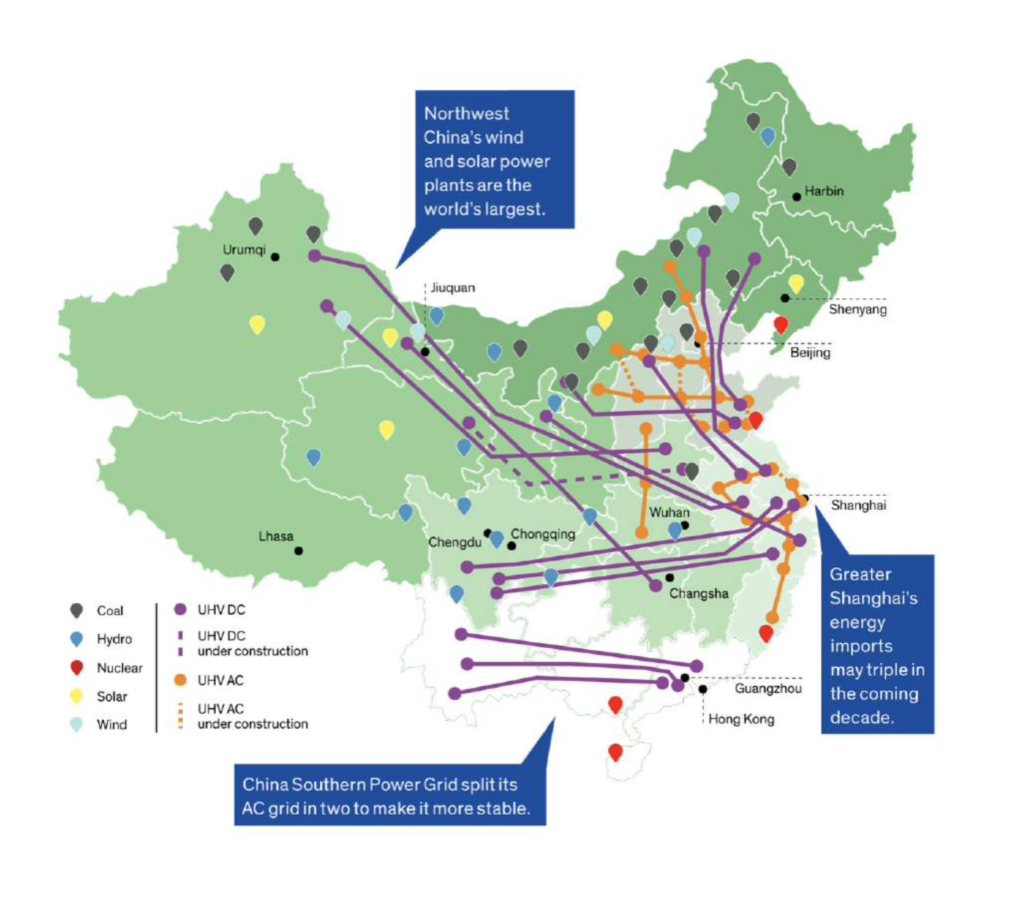

Case Study: China’s Role in Global Grid Modernization

Commercial banks have in their response to the global pandemic, provided prudential forbearance to vulnerable sectors of the economy via payment moratoriums, late payment waivers and extension of working capital facilities and loans. Commercial banks acted quickly to activate business continuity plans to meet the banking needs of clients in critical times without compromising the […]

Establishing National Green Banks Could Accelerate Low-Carbon Economies and Financing in Southeast Asia

A green bank can crowd-in private sector financial institutions to help finance green projects. But before providing such funds, local commercial banks and especially small- and medium-sized banks should acquire the necessary green financing capacity to offer technical assistance through advisory services. The green bank should, therefore, provide innovative financial products and advisory services simultaneously to attract private investors […]

Power Outages in the Philippines: Unexamined Positions

The Senate Energy Committee continues its inquiry to address the rotating blackouts this year. According to Energy Secretary Alfonso Cusi, the power outages are caused by unplanned and extended maintenance shutdowns of high generation capacity power plants. For example, from 31 May to 2 June, the four plants with combined capacity of over 2000 MW […]

How Can Private Sector Financial Institutions Accelerate Green Finance and Transition to a Low Carbon Economy in Southeast Asia?

Government support is pivotal to crowd in private sector capital to scale up green finance opportunities in the Southeast Asia region and pave the way for a low-carbon economy. The report highlights investment opportunities in the green economy, groundbreaking financial products needed to mobilize private sector finance, and actionable measures that cooperating policymakers, private and […]

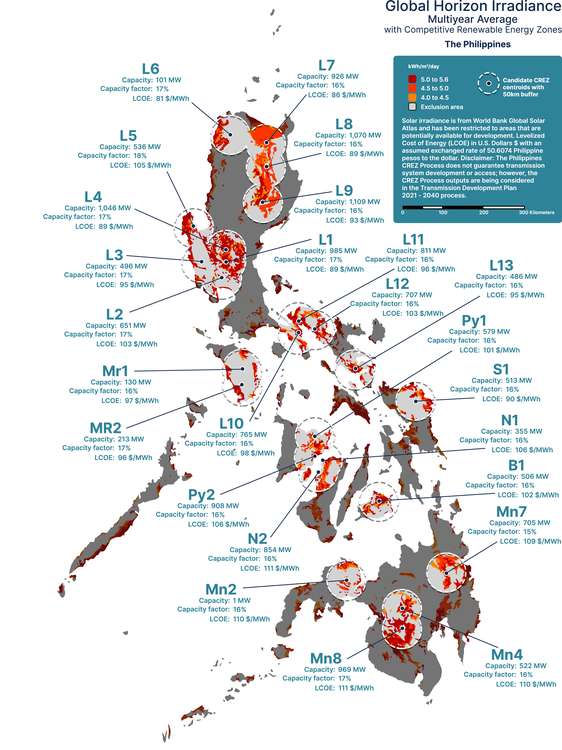

Grid Modernization as part of the Philippines’ Nationally Determined Contribution Enhancement

Grid modernization allows for the power system to take advantage of rapid technological improvements to improve cost-competitiveness and socio-economic outcomes. Transmission planning is a key control lever that the Department of Energy can use to influence the grid’s capacity and prioritize domestic renewable energy sources. Mapping the grid and understanding the implications of new technologies is […]